Benjamin Franklin said, “An investment in knowledge always pays the best interest.”

A personal commitment to continuous learning benefits you greatly through life. It directly correlates to a mind of self improvement which speaks to the kind of person you are or aspire to be.

In this edition:

Investing as a transferable life skill

Introducing: The buffet

Cleaners are built different

STORY

Investing for life, pt. 1

I’ve spent most of my professional years in the world of investments. Knowing what I know now, I'm of the opinion that learning how money works is an investment everyone must make.

My world didn’t revolve around it, but it also did in a way. The world does. We live in a capitalist world, and capital is at its core.

Capital refers to the resources used to produce value. These resources aren’t infinite.

Investing is the act of deploying capital.

When we deploy any resource expecting a beneficial result, we are, in fact, investing. So, the principles and concepts that result in successful investing are transferable. One aim of this newsletter is to transfer my refined interpretations to you.

Besides money, time and energy are two other scarce resources that you have available to you. Scarce in that they aren’t infinite to you as an individual. I will share frameworks to help you allocate those assets to generate most value.

Your life is your longest investment. As long as you have days ahead of you, you can alter your outcomes. The same principles that guide great financial investments can also guide great 'life investments'.

You will never have too much knowledge, but it is possible to have too little. The latter, in my view, is a poor investment decision.

When armed with investing knowledge, you see the world around you differently. You act on information to make decisions from a better vantage point. So even now, I continue learning.

I admit, it can be boring to think about inflation or interest rates and all ‘that finance stuff’ (…yawn). But if you identify the ‘dots’ you need, and take the time to collect them, there’s a lot of fun in connecting them. Learning about investing is a worthwhile investment.

SPOTLIGHT

Everybody is looking for something

Here are my picks from the news in the week in investing & investing in tech that are worth knowing:

Acquisition of Bamburi Cement gets complicated as parent, Holcim, halts the sale to Tanzania’s Amsons Group even as Kenya’s Savanah Cement increases bid for the company.

HF Group is looking to raise KES 6bn in a rights issue, offering existing shareholders an opportunity to buy 2 new shares for every existing share owned at KES 4.00 per share.

Kenya’s Treasury is looking to tame high interest rates by involving more non-bank financial institutions in local T-bills and bonds.

The NSE has received approval to offer Options Derivatives trading. Options are financial derivatives contracts that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date.

Stakeholders meet to deliberate on Kenya’s recently introduced crypto tax.

Africa startup funding recovery in Q3 favours fintech. Hopefully better times ahead?

THE BUFFET

Before you deploy that capital…

Introducing, The buffet. Just like a real buffet, this part of the newsletter will give you a mix of handy info to pick from. And just like the real Buffet, the info here will be the kind the world’s greatest investor would approve.

Today’s food for thought:

6 things you should consider before making financial investments.

Goal: This is what you are working towards achieving by investing. Goal setting should precede any investment activity.

Available capital: Some investments require large initial amounts, while others are made for small regular sums.

Term or duration: Attached to your goal, your horizon also determines what kind of investments suit you better.

Risk tolerance: Investments come with the risk of loss to varying degrees. Knowing your personal tolerance helps you build a strategy that aligns with your unique circumstances.

Diversification: Spreading investments across different asset classes and industries helps you get better returns and manage risk.

Liquidity: This refers to how quickly the investment can be converted back to cash. It’s important to be clear on this before investing your money.

More on these in future posts.

NOTES TO SELF

What kind of player are you?

In sports, there are good and great players.

Then there are players who become almost synonymous with their sport for decades. The MVPs, GOATs, Icons or whatever other title we place upon them. They are a rare kind of high performer.

They make it look easy, because they work harder than everyone else.

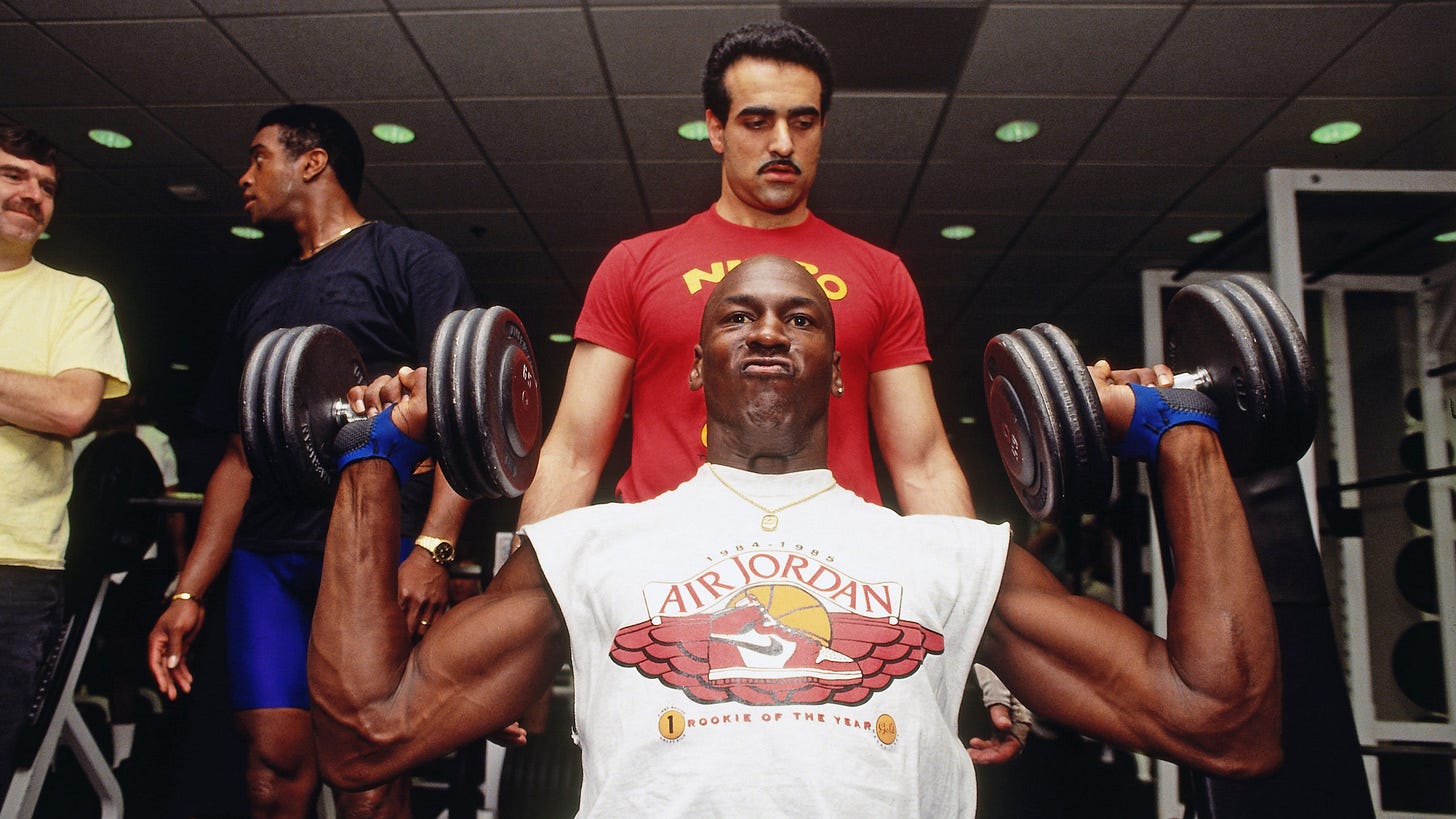

Tim Grover was a performance coach for Michael Jordan, Kobe Bryant and other NBA superstars.

Being very close to these players for years and a contributor to their success, he observed and learned a lot about high performers. Listen to this short where he defines 3 types of players: Coolers, Closers, Cleaners i.e. Good, Great, Unstoppable.

Teams, whether in sports or in other settings, all have such players. In life, everyday is game day. What kind of player are you in the different spaces you occupy?

What can you learn from the Cleaner mentality?

“The most powerful tool of your mind is not its capacity to know, but its ability to question.”

Is there such a thing as “too much of a good thing”?

In the pursuit of better, we must be willing to put in the work required to get extraordinary results — in money or in life.

Extraordinary results are achieved by putting in extra work.

Have the best week possible.

Yours truly,

AG